How to Leverage Salesforce CPQ and Billing for Order-to-Cash Efficiency

Does your business need a more efficient order-to-cash process? It’s possible when you leverage the power of Salesforce CPQ and Billing for OTC. Read on to learn more.

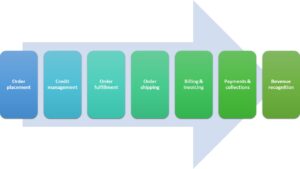

What is Order-to-Cash?

Order-to-cash (OTC) describes all the processes involved in processing a customer order and booking the associated revenue as cash. It includes everything from the initial order placement through order fulfillment and shipping through invoicing and collections to recording revenue. The OTC process involves multiple departments in your company – sales, credit, shipping, and finance – and the movement of information from one department to the next.

The order-to-cash process used in B2C transactions is subtly different from the similar quote-to-cash (QTC) process which is more typical in B2B transactions. Because of the unique aspects of B2B transactions, QTC adds configuration, quoting, and pricing to the front end of the OTC process before order placement. From that point on the two processes are identical.

Order Placement

The OTC process begins when a customer places an order— typically through your company’s sales department. At this point, the order is entered manually or automatically into your system.

Credit Management

Once the system enters an order, it sends it to your company’s credit department. Assuming the customer is not paying cash up front, the credit department conducts a thorough review of the customer’s credit and accesses the ability of the customer to pay for the order.

Order Fulfillment

Either after or during the credit management process, there is an inventory check to ensure the order can be filled. If insufficient inventory is on hand, orders must be placed for additional inventory if available. The customer should be informed of any potential shipping delays.

Order Shipping

When the customer’s credit is approved, the order is sent to your shipping department. The product is then pulled, packed, and prepared for shipment. When the shipment is ready, the shipping department passes it to the appropriate carrier service for delivery to the customer.

Billing and Invoicing

Post-delivery, the system transmits the order to the finance department. . The finance department generates an invoice and delivers it either physically (by postal mail) or electronically (via email). The system marks the invoice as open.

Payments and Collections

Ideally, the customer pays the invoice within the allotted timeframe. If not, the invoice goes to a collections person, department, or service to remind the customer that payment is due.

Revenue Recognition

When payment is received it is matched with the open invoice and the invoice is marked as closed and reconciled to cash. The transaction is recorded and archived into your general ledger.

What is Salesforce CPQ and Billing?

Salesforce CPQ and Billing is part of Salesforce Revenue Cloud. Revenue Cloud connects all aspects of a company’s sales and finance functions to create a seamless experience for customers. Salesforce CPQ automates the Configure, Price Quote process while Salesforce Billing is an add-on package that automates invoicing, payment, revenue recognition, and the rest of the backend process. Orders are placed within Salesforce CPQ and then sent to the Billing module for invoicing, payment, and booking the revenue.

Companies using Salesforce CPQ and Billing realize numerous benefits, including:

- Streamlined OTC and QTC processes

- More accurate billing

- Flexible billing arrangements

- Automated billing for subscription-based products

- More accurate forecasting

- Strong customer relationships

The following Salesforce video details how Salesforce CPQ and Billing works.

How Can You Use Salesforce CPQ and Billing to Create a More Efficient Order-to-Cash Process?

Because OTC is a series of cross-departmental processes it can sometimes be slow and difficult to manage. Orders can get lost in the transfer, bureaucracy can set in, and errors are not uncommon. It’s in your company’s best interest to streamline this process — which can be done by using OTC or QTC software, such as Salesforce CPQ and Billing.

Salesforce CPQ and Billing automates all aspects of the OTC process. This improves efficiency throughout the entire process and across all departments. The OTC process is streamlined and shortened, which improves cash flow and makes cash management easier.

In addition to streamlining the entire process, Salesforce CPQ and Billing reduces the risk of:

- Lost orders

- Order errors

- Unfillable orders due to out-of-stock situations

- Billing and invoicing errors

- Uncollected payments

- Lost or misfiled payments

- Accounting errors

In addition, Salesforce CPQ and Billing provides the highly accurate data you need to better manage your company’s day-to-day operations. This data is also valuable for improving data analysis and creating more informed forecasts and long-term planning.

More Efficient Order Management

Salesforce CPQ and Billing enters all orders automatically into the system. This reduces the risk of order errors and ensures that sufficient inventory is available to fulfill each order. Orders entered into the system also trigger appropriate actions later in the OTC process, even across departments.

More Accurate Invoicing

Orders placed into the system are automatically processed for billing and invoicing. Error-free invoices are automatically generated and sent to customers at the appropriate time. This speeds up both invoicing and payments and reduces the risk of lost or unsent invoices.

Faster Payment Receipts

When a customer payment is received, it is automatically matched with the proper account and invoice. Payments are deposited quickly and don’t sit on a desk or in the system waiting to be processed.

More Efficient Revenue Recognition

Payments received are automatically reconciled in your general ledger. There is no manual entry necessary. Cash allocation is fast and accurate and requires little or no human interaction. You save on administration costs and free up finance and accounting staff for other important activities.

More Useful Reporting and Analysis

Salesforce CPQ and Billing provides real-time data and reporting you can use to more closely manage your day-to-day operations. The same data helps you create highly accurate cash and budget forecasts and provides actionable insights you can use for longer-term planning.

Let Rainmaker Help You Create a More Efficient Order-to-Cash Process

When you want to automate your OTC process, turn to the Salesforce experts at Rainmaker. We help you integrate Salesforce CPQ and Billing into your existing systems and create a more efficient backend process. We also offer a wide variety of Salesforce Managed Services to help your company grow sales, improve customer service, and turn more leads into contacts, accounts, and opportunities.

Contact Rainmaker today to learn more about Salesforce CPQ and Billing!